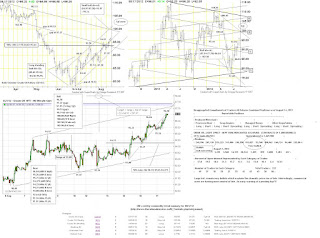

Price analysis for the week of August 24th, 2012:

Market

Overview: Prices felt like they were nearing exhaustion into the end of this past week. The market did get a boost from very dovish comments from the US Federal Reserve (through the release of the Fed Meeting Minutes). As a result, the US

dollar lost a good deal of 'rate' premium and even went as far as to

price in a resumption of the very controversial 'quantitative easing'

program. Should a QE3 begin in earnest, one ought to expect a dramatic

escalation in prices very similarly to our last two rounds. Indeed, gold

and silver both seem to be pricing in a reversal of previously

dis-inflationary policy and a resumption of US

dollar devaluation. Not only have prices based but we may actually be

setting up for a substantial move higher. Oh, did I mention, the S&P

500 is at a new 52 week high...

Trading Plan for this coming week: As stated above, I shall be looking for this move to continue to the upside but do expect quick violent moves lower to try and flush out as many 'weak hands' as possible. Continue to use 'OTE' setup to identify buying and selling opportunities at key support/resistance levels on the 60m chart outlined above.

Weekly

highlight: The previously mentioned large purchases by Institutions coupled with the renewed talk of QE3 and indeed the market moved higher. Comments from last week's post continue to seem pertinent: Additionally, the rather

noticeable breakdown in the US long treasury market suggest that higher,

not lower asset prices ought to be expected for at least the next

little while. Good corporate earnings, good economic numbers and a

friendly US Federal Reserve Board have all laid the groundwork for a

significant test of the spring stock market highs and in my opinion a

substantial move higher over the coming weeks/months.

Trading Strategy (1 month): As we head towards Labor Day and even into the first week or so beyond, I am leaning towards higher, not lower prices. New upside objectives include a

small daily bull ab=cd (target of 99.74) as well as a

gap that ought to be filled at 99.53.

Lastly, we do have a rather noticeable weekly bullish ab=cd currently

working which in itself suggests prices want to eventually move towards

the 102.50 area (which happens to correspond with the same level as the massive daily bull ab=cd, 102.54).

Trading Plan for this coming week: As stated above, I shall be looking for this move to continue to the upside but do expect quick violent moves lower to try and flush out as many 'weak hands' as possible. Continue to use 'OTE' setup to identify buying and selling opportunities at key support/resistance levels on the 60m chart outlined above.

Picture everyday my ideal trade....looking for complete washout at or near OTE/HG zones on 1hr/4hr charts.

b2 aoco (-.24/+.10/+.41)....on fill leave stop on remaining at original level! Risk becomes $130. Reward if target hit = $500.00. If system is 70% accurate. in 10 trades net ret. = 3500 - 1500 = +2000.00

Focus

for the week: I feel more comfortable in the trading seat than I have before and I believe that is a direct function of closely examining my feelings behind trading (as outlined in prev. homework from TsT's Dr. M.). This past week's homework was and is to pick one or two process goals and work very hard on both achieving the goal but also in creating some sort of feedback loop to assess and reassess progress. Picturing myself executing my ideal trade every morning and each time I take a 'market state' reading shall be my process goal for the coming weeks. It shall be interesting to see if it cuts down on a lot of the little nonsense trades one gets oneself into out of boredom...

That's all for this post,

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/