The first picture is the daily, weekly and 120 minute charts with Crude Oil's term structure and CoT summary for the week of Nov. 1st, 2013. Each trading day (time permitting) a 15 minute chart is added and trades for that day are reviewed:

Market Overview: October has come and gone for 2013 and there was no crash, phew - now back to business. Washington has played kick-the-can once again (with regard to its debt ceiling issues) and considering seasonality, I wouldn't be surprised to see the market work its way higher into both year end and that new political event (which will be at some in the early new year). Of course, the market never moves in a straight line but for the time being the trend continues to point higher for asset prices in general and especially so for equities in particular. Within a backdrop of relatively neutral Fed. policy and stable corporate earnings, this scenario may seem hard to understand. But given both energy and grain price weakness of late, it would seem the consumer is being given a break at both the grocery store and the gas pump which may explain a more enthusiastic macro economic picture.

Weekly highlight: As mentioned above, crude oil prices dropped appreciably over the course of the past week. So too have the by-products (heating oil & unleaded gas) suggesting North American energy demand may be waning at these lofty levels. Adding further weight to this thesis, Brent / WTI spreads have been widening of late suggesting the European economy is robust and local demand strong. Several macro issues are influencing energy prices too. From the unwinding of massive long positions by bankrupt Brazilian tycoons to the opening of new supply pipelines out of Cushing Oklahoma, there is no shortage of reasons for energy prices to have paused of late. While a few short term downside targets have been hit (small bear ab=cd on 2hr chart & weekly 50% level) several larger downside targets remain (large bear AB=CD on 2hr chart & key low tests on the daily and weekly chart). Rallies into resistance remain good shorting opportunities while panic sell-off lows remains speculative buying opportunities.

Personal journal: I am very proud of myself for exercising extream patients and discipline through my self imposed LTP. While I didn't knock the cover off the ball (up a net 30 ticks over the two week period) I did meet my simple requirement of trading like a professional for two consecutive weeks and only taking legitimate trading plan setups. I shut down twice through that period (hitting personal loss limit) but percerviered through the period and did indeed see that through consistency and focus, profits can be made. I feel as though TsT has been very patient with me and it is time for this little baby bird to fly.

Trading Plan: All trades from here on are LIVE. HVT setups where price has entered an OTE zone, momentum is currently in diveregence on 15m/3m, price is above or below daily Volprofile VH/VL and re-entering it and 3 bar 1m price reversal pattern as entry. All orders entered on an AOCO basis on the completion of 1m 3bar pattern at entry level. AOCO Stop at no more than -14, exit must be at least 1.5 times risk or +21 ticks. Order should rest near 38.2% retracement of prior move, PoC, Recent H/L. MUST SHUT DOWN on 2 initial losses or breach of 50% highwater mark on the day.

That's all for this post,

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/

Brian Beamish FCSI

The Canadian Rational Investor

the_rational_investor@yahoo.com

http://www.therationalinvestor.ca

http://crisdaytrading.blogspot.ca/

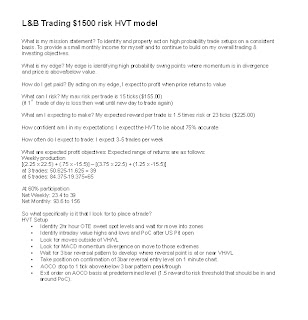

Screenshot of current L&B trading plan:

No comments:

Post a Comment